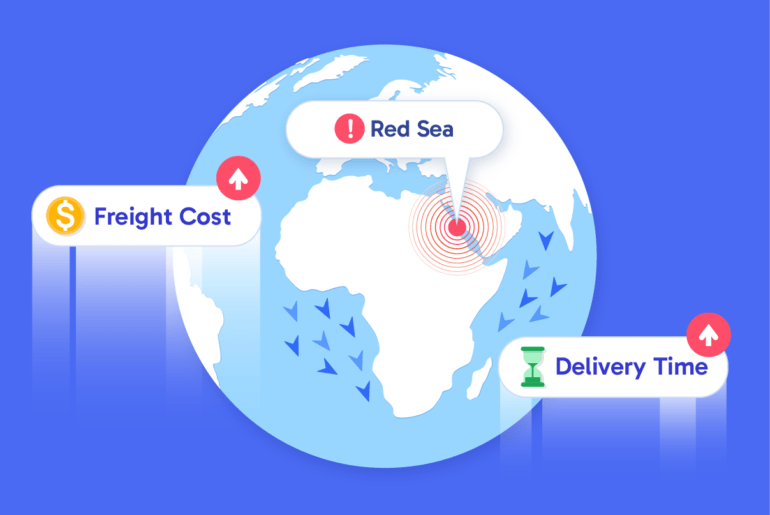

Due to recent events, global shipping companies have been forced to suspend Red Sea voyages and set new routes. Commercial ships prefer to pass through the Cape of Good Hope instead of entering the Red Sea.

Italian-Swiss Mediterranean Shipping Company (MSC), one of the world’s largest container carriers; Maersk of Denmark; Hapag-Lloyd of Germany; and CMA CGM of France are among the companies that have suspended sailings in the Suez due to failing in security conditions. British energy giant BP announced in a statement that all tanker traffic through the Red Sea had temporarily been stopped; “due to security concerns in the route, BP has decided to stop all tanker temporarily transits through the Red Sea.”

The Position of the Suez Canal in Global Trade.

Roughly 10% of all world trade is conducted through the Suez Canal, connecting the Mediterranean to the Red Sea via the Mediterranean-Red Sea waterway – providing Europe and Asia the shortest path. Every day, over 50 ships pass through, carrying billions of dollars worth of goods for distribution in North Europe, Mediterranean regions, and East Coast North America.

What are the effects of the attacks on the Red Sea?

As was predicted, container ships rerouting from the Red Sea attacks to other routes would increase transit times, delays, and costs; they have. Furthermore, British energy company BP raised concerns that the problem affecting goods transport could spread to energy shipments; unrefined oil prices climbed more than 2 percent as a result.

Attacks often have far-reaching economic results. With the effect of the Russia-Ukraine war, Red Sea transits for energy imports have grown increasingly.

However, ships now must travel an additional 4,000 nautical miles if routes change to the Cape of Good Hope in southern Africa for energy shipments; this increases freight costs and delays delivery times.

Experts estimate that routing to the Cape of Good Hope increases delivery times for container ships by approximately two weeks and for tankers by one week. They also warn companies that they should be prepared for higher freight prices; imports could cost an extra $80 per standard container (1 TEU). While exports would incur 90 euros more expensively than the current average market pricing on long-distance routes of $1030 (1 TEU). Furthermore, companies also face increased insurance premiums as a result of the attacks.

Route change would cost 1 million dollars per ship.

Peter Sand, Chief Analyst of freight market analysis firm Xeneta, noted that the attacks caused significant disruptions in container transportation networks, cutting an essential passage of global supply chains in half. Many shipping companies suspended transit while some service providers rerouted around Cape of Good Hope – with each change costing an additional $1 Million in fuel costs per ship that does not travel via Red Sea/Suez Canal routes.

On being asked whether this could become destructive like the “Covid-19 period” when FEU (Forty-foot Equivalent Unit) prices reached $14,000 per container, Sand answered in the negative. While prices might double on trade routes affected by tariff increases, this should only increase to about $4,000 per FEU.